Consumer Consent Management for Open Banking

Control and consent over information will become crucial with the Open Banking evolution in Canada.

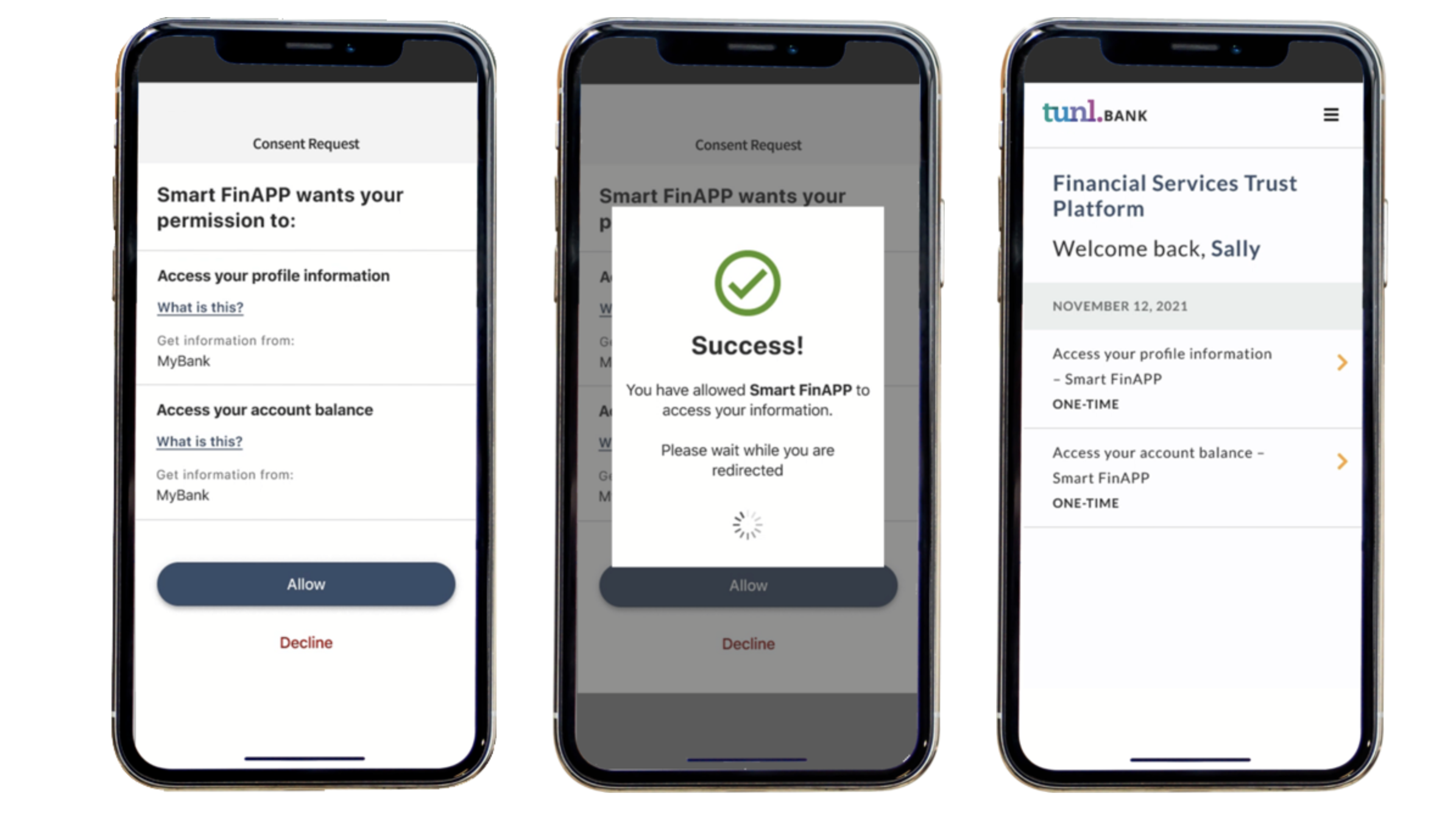

Perform financial transactions and consent management

Guaranteed that personal information is protected, customers are given the ability to perform financial transactions and consent to data sharing inside their financial institutions and beyond.

- Enable client directed consent and data sharing among various lines of business

- Save significant technical costs with a scalable data integration pattern

- Earn customer loyalty by offering more efficient, customized and pertinent services

- Engage clients with access to various services, leveraging existing KYC

- Connect to trusted third party partners and services, and monetize connections

- Maintain privacy and loyalty with user consented data sharing and authorization

- Consent-driven data collaboration between service providers

- Privacy-preserving and secure interactions, which respect jurisdictional requirements

- Increase customer loyalty with seamless and connected banking experiences